Strong downside rejection slowed bears but n/t focus remains shifted lower

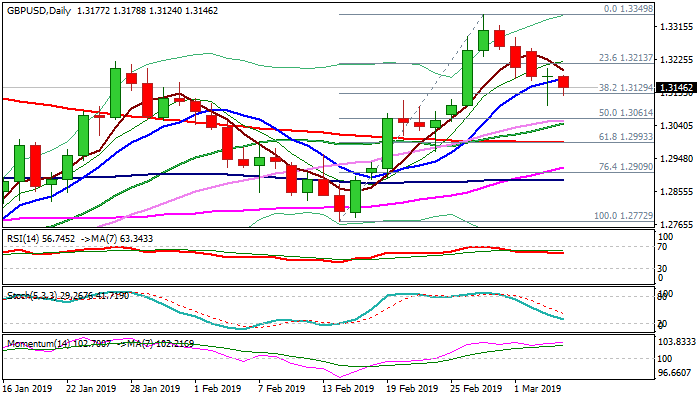

Cable remains in red on Wednesday and attacks again pivotal Fibo support at 1.3129 (38.2% of 1.2772/1.3349) despite Tuesday’s log-tailed Doji, formed after strong downside rejection at 1.3097 and subsequent bounce.

The pound dipped after talks between top UK/EU officials in attempt to save PM May’s plan resulted in no agreement on Tuesday, but regained ground after comments of BoE Governor Carney who said that most recent forecasts showed inflation above central bank’s target and the path of interest rates is not firm enough.

Fresh acceleration resulted in failure to close below cracked 10 SMA (1.3171) and Fibo support at 1.3129, slowed bears but did not signal reversal that keeps the downside vulnerable.

Renewed concerns about no-deal Brexit increased pressure n pound, but clear break below above mentioned pivots is needed to confirm scenario and open way for further easing towards targets at 1.3053/45 (converged 20/30SMA’s) and key support at 1.2993 (200SMA / Fibo 61.8% of 1.2772/1.3349).

Holding above 10SMA would further question near-term bears, as positive momentum remains strong daily chart, but stronger reversal signal requires lift above minimum 1.32 handle.

Res: 1.3171; 1.3193; 1.3223; 1.3265

Sup: 1.3124; 1.3097; 1.3061; 1.3045