Bears may extend towards key 1.11 support zone

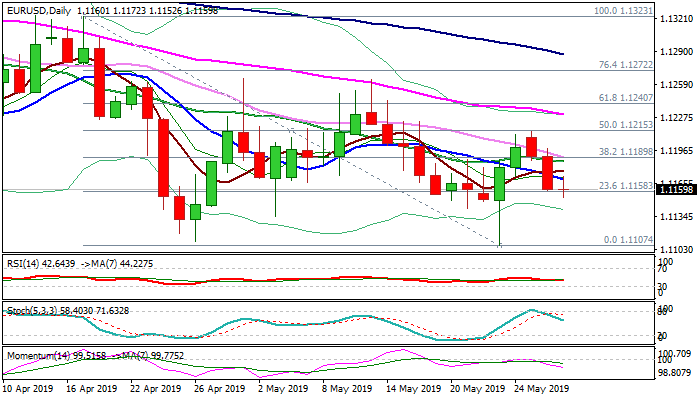

The Euro holds in red for the third straight day and extends weakness from 1.1215 lower top (27 May) to new one-week low in early Wednesday’s trading.

Stronger dollar on renewed risk aversion and uncertainty over EU’s economic and political situation keeps the Euro under pressure.

Tuesday’s long bearish daily candle (the biggest one-day loss since 24 Apr) weighs, along with bearish signal was generated on Tuesday’s close below 10SMA.

Daily MA’s turned to full bearish setup and rising bearish momentum add to negative outlook.

Bears look for fresh signal on break below Fibo support at 1.1148 (61.8% of 1.1107/1.1215) that would expose key supports at 1.1111/07 (26 Apr / 23 May lows) the lowest levels since mid -May 2017.

Broken 10SMA (1.1169) marks initial resistance, guarding pivots converging 20/30 SMA’s (1.1185/90).

Only firm break above 1.1215 (Mon high / 50% retracement of 1.1323/1.1107) would neutralize downside risk.

German labor data are due in a while and expected to give fresh signals.

Res: 1.1169; 1.1190; 1.1215; 1.1230

Sup: 1.1148; 1.1132; 1.1111; 1.1107