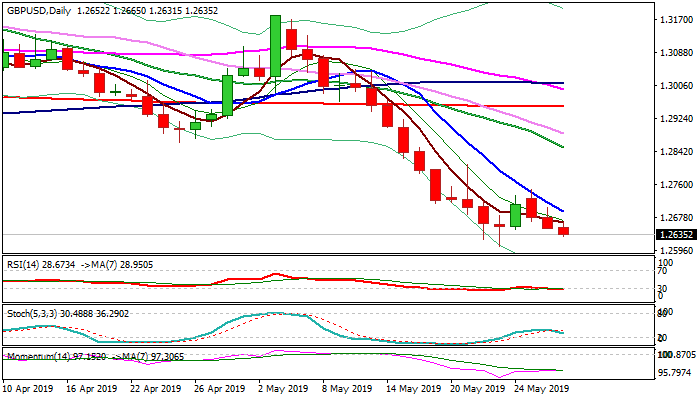

Bears remain fully in play and focus key support at 1.2605

Cable extends weakness in early Wednesday’s trading to the lowest in almost one week and focuses key support at 1.2605 (23 May low) the lowest in nearly five months.

Near-term structure turned negative after brief recovery was capped by falling 10SMA and Tuesday’s extension and close below 5SMA confirmed lower top at 1.2747 (recovery top, posted on Mon).

Daily techs remain in full bearish configuration and support scenario, but fears of no-deal Brexit generate the strongest pressure on pound.

Prevailing idea among the candidates to succeed Theresa May on Prime Minister position is that the UK should leave the union on 31 Oct, even without deal.

Dissonant tones come from Labor Party leader Corbyn who supports the idea of second referendum on Brexit and even national election that would reunite the country, deeply divided over Brexit.

Immediate risk will remain at the downside while the price holds below falling 5 and 10SMA’s (1.2666 & 1.2694 respectively)., with sustained break above the latter to ease bearish pressure, but lift above 1.2747 recovery top needed to confirm and signal further upside.

Bearish scenario sees increase of pressure on violation of 1.2605 pivot that would expose target at 1.2508 (Fibo 76.4% of 1.1930/1.4376).

Res: 1.2666; 1.2694; 1.2707; 1.2747

Sup: 1.2605; 1.2588; 1.2508; 1.2476