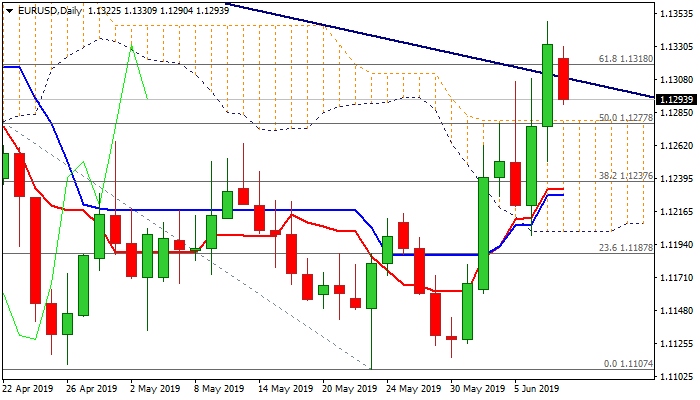

Bulls are re-positioning for fresh upside; daily cloud top marks key support

The Euro stands at the back foot in early Monday’s trading and probes below 1.13 handle, on easing from new 2 ½ month high at 1.1347.

Traders took profit from strong Thu/Fri 1% rally, as weak US jobs data on Friday sent dollar lower and further boosted Euro.

News that US and Mexico reached deal to avoid tariffs on Mexican goods, lifted dollar on Monday, offsetting partially negative impact from downbeat jobs data.

The pair generated strong bullish signals from Friday’s rally that eventually broke and closed above daily cloud top and extension higher that resulted in close above pivotal barriers at 1.1308/18/23 (trendline resistance / Fibo 61.8% of 1.1448/1.1107 / mid-Apr lower platform).

Current pullback could be seen as positioning for fresh advance (as bulls eye key 200SMA barrier at 1.1367) if broken pivotal barriers, now strong supports, at 1.1279/74 (daily cloud top / 100SMA) hold dips.

Daily MA bull-crosses (5/100 and 10/55SMA’s) underpin and support scenario.

On the other side, extension and close below cloud top / 100SMA would weaken near-term structure and risk deeper pullback.

Res: 1.1309; 1.1318; 1.1347; 1.1367

Sup: 1.1279; 1.1274; 1.1259; 1.1231