Pound eases after downbeat UK data and eyes key 10SMA support

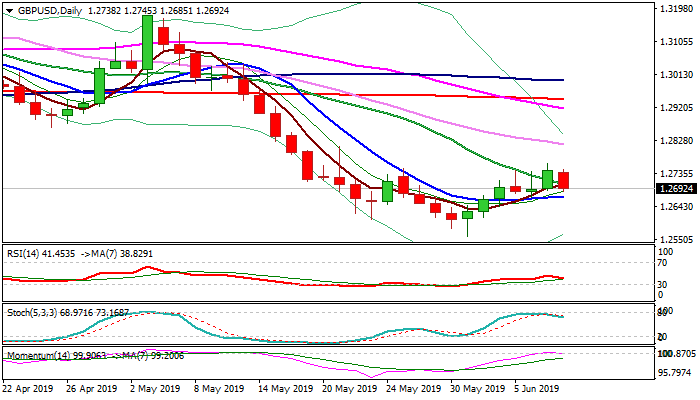

Cable accelerated lower after weaker than expected UK data, extending pullback from Friday’s post-US jobs data rally high at 1.2762.

Disappointing data (GDP -0.4% vs -0.1% f/c; IP Apr -2.7% vs -0.7% f/c; MP Apr -3.9% vs -1.1% f/c) add to existing pressure on Brexit concerns and race for new UK Prime Minister, as well as fresh dollar’s strength on relief news about US/Mexico trade conflict.

Fresh weakness returns below broken 20SMA (1.2704), increasing risk of deeper pullback and signal that corrective leg from 1.2559 low might be over.

The notion is supported by south-reversing daily momentum and stochastic, with sideways-moving 10SMA (1.2668) marking pivotal support, close blow which would generate stronger bearish signal.

Hopes of fresh upside attempts would stay alive while the price holds above 10SMA, but catalyst will be needed to spark bullish action.

Res: 1.2704; 1.2745; 1.2762; 1.2796

Sup: 1.2685; 1.2668; 1.2610; 1.2580