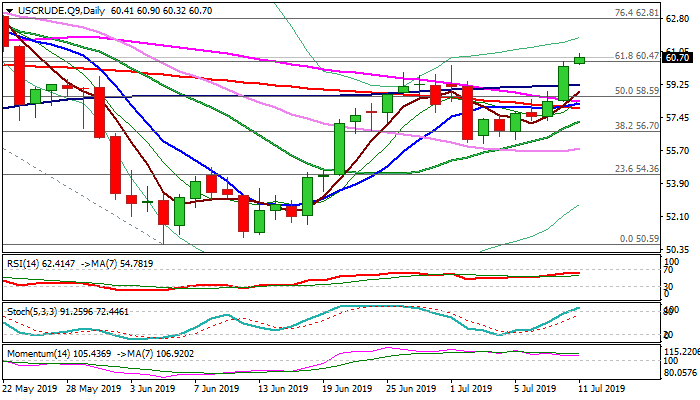

Fresh bulls extend above important Fibo barrier at $60.47

WTI oil price hit the highest level since 23 May and establishing above psychological $60 barrier, in today’s extension of Wednesday’s 3.2% advance.

The oil price received fresh boost from significant drop in US crude inventories (EIA report showed draw of 9.4 mln bls vs forecast at -3 mln bls and previous week’s drop of 1 mln bls).

Adding to positive signals was Wednesday’s incident with British tanker in the gulf, which heated existing tensions in the region.

Improved sentiment after OPEC+ group decided to extend production cut agreement until March 2020 adds to positive outlook, as fresh extension higher broke above important Fibo barrier at $60.47 (61.8% $66.58/$50.59) and daily close above is expected to generate fresh bullish signal.

Daily Ichimoku studies and MA’s are in full bullish setup, but weaker momentum warns that bulls might be obstructed.

Sustained break above $60.47 would open way towards $61.78 (20-d upper Bollinger band) and $62.81 (Fibo 76.4%) in extension.

Holding above broken $60 level is needed to keep bulls intact, however, extended dips towards $59.21 (100DMA) cannot be ruled out as daily stochastic is overbought.

Res: 60.90; 61.38; 61.78; 62.00

Sup: 60.47; 60.27; 60.00; 59.21