Euro on roller-coaster after unchanged ECB; less dovish than expected Draghi

The Euro fell to new 2019 low at 1.1101 in strong bearish acceleration after the ECB stayed on hold in today’s meeting, changed its forward guidance and pointed towards more efforts to push inflation towards its 2% target.

The ECB expects the key interest rates to remain at present or lower levels through the first half of 2020 and including the possibility of lower rates, added to dovishness of the message, as markets understood it as leaving the door open for September’s rate cut that sent Euro lower, despite the central bank kept rates unchanged.

Upbeat US durable goods data lifted dollar and added to Euro’s weakness.

The single currency bounced quickly in subsequent rally from new low, as traders booked profit and positioning for fresh attempts lower.

Mario Draghi, the ECB’s President, in his post-meeting press conference pointed to weak inflation, weakness in growth, also affected by Brexit and slower Chinese economy, saying that outlook is getting worse and worse, but markets took his remarks as less dovish than expected, as he said that rate cut was not discussed.

This signals that the ECB needs more evidence, especially from Fed policy meeting next week, as well as how the situation in US/China trade talks will develop, before taking bigger steps

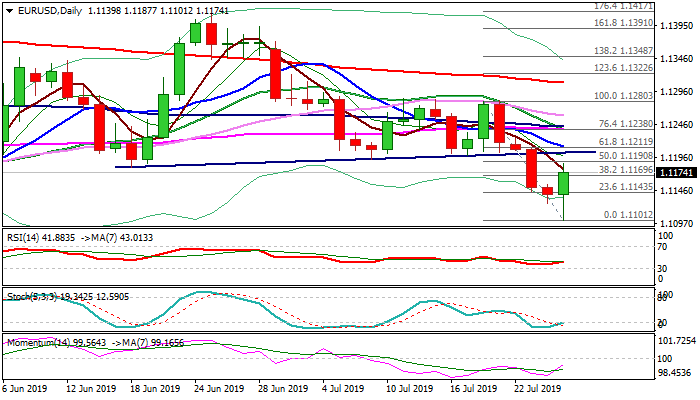

Recovery action, after bears faced strong headwinds from key 1.11 support zone, broke above first pivot at 1.1169 (Fibo 38.2% of 1.1280/1.1101) that exposes key barriers at 1.1200/12 zone (former congestion lows / Fibo 61.8% of 1.1280/1.1101).

While these barriers hold, recovery action could be seen as better selling opportunity.

Conversely, firm break here would put larger bears on hold for stronger correction.

Res: 1.1187; 1.1200; 1.1212; 1.1238

Sup: 1.1169; 1.1143; 1.1126; 1.1101