Bulls hold grip but stay capped below key Fibo barrier

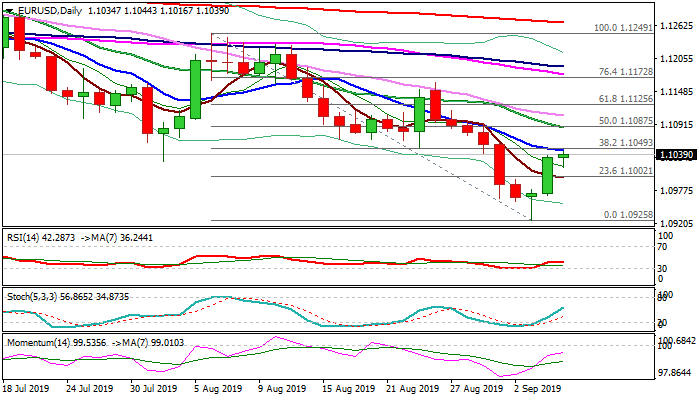

The Euro remains constructive in European trading on Thursday as Tuesday’s long-tailed hammer and Wednesday’s long bullish daily candle underpin the action, but bulls face strong headwind from pivotal barrier at 1.1049 (Fibo 38.2% of 1.1249/1.0925, reinforced by falling 10DMA) and stay below for now.

Downbeat German Factory orders (July -2.7% vs -1.5% f/c and 2.7% in June) weigh and help keeping the upside limited.

Rising daily momentum and stochastic help bulls to maintain grip, but break and close above 1.1049 pivot is required to signal continuation of strong recovery from 1.0925 (3 Sep low).

Failure to clear 1.1049 trigger would signal extended consolidation but also keep the downside vulnerable.

Return and close below 1.10 support would signal recovery stall and shift near-term focus lower.

Res: 1.1049; 1.1086; 1.1106; 1.1125

Sup: 1.1016; 1.1000; 1.0968; 1.0925