Trade talks optimism underpins, but key 106.80/107 barriers resist for now

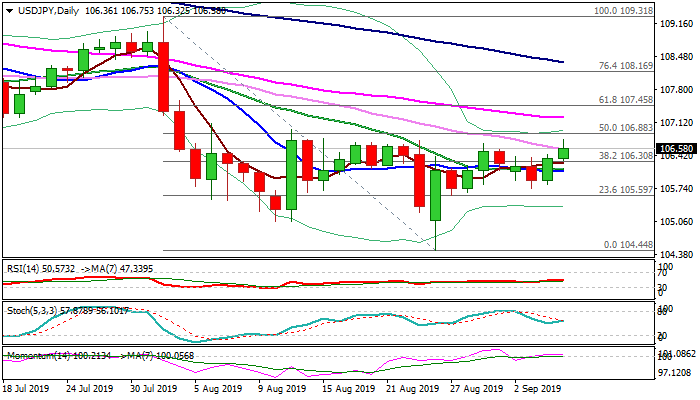

Extension of Wednesday’s rally that left daily bullish engulfing and generated positive signal, failed on initial attempt through 106.70 zone (highs of 29/23 Aug / falling 30DMA) on Thursday.

Improved sentiment on fresh hopes over US-China trade talks that will continue in October, keep risk mode in play for further advance.

On the other side, flat daily momentum and solid offers from Japanese exporters at 106.80/107, mark the zone as significant obstacle, where bulls may face strong headwinds.

Firm break above 106.80/107 obstacles (reinforced by daily Kijun-sen and 50% retracement of 109.31/104.44) would generate strong bullish signal and open way for further advance.

Prolonged sideways movements can be expected on repeated failure to break higher, but near-term bullish bias will remain in play while converged 10/20DMA’s (106.11/15) hold dips.

Res: 106.75; 106.88; 107.00; 107.45

Sup: 106.44; 106.32; 106.11; 105.82