Bears found footstep after Monday’s strong fall but risk remains shifted lower

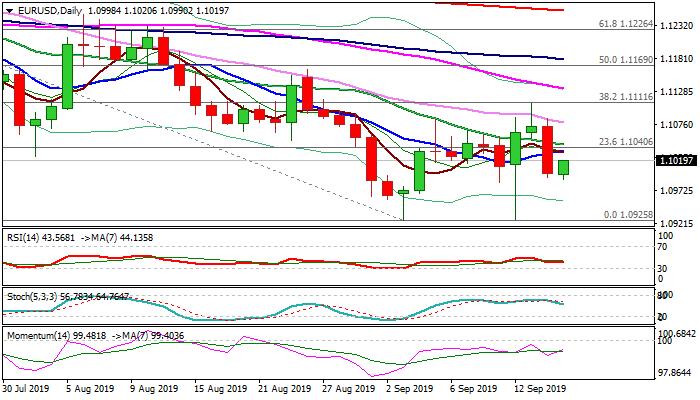

The Euro found footstep and moved above broken 1.10 support after bulls were trapped at 30DMA and stalled on approach to pivotal Fibo barrier at 1.1111 with subsequent acceleration lower on Monday, resulting in 0.68% fall (the biggest one-day loss since 31 July).

Completion of reversal pattern and Monday’s marginal close below psychological 1.10 support add to negative near-term signals, along with bearishly aligned daily studies.

Markets await release of German ZEW data, key event for Euro today, for fresh signals.

German economic sentiment is expected to slightly improve in Sep, but figures remain negative, suggesting little help for the single currency’s recovery attempts, while weaker than expected outcome would risk fresh weakness and expose key supports at 1.0925/26 (3/12 Sep lows).

Bulls would re-take control only on sustained break above 1.1111 (Fibo 38.2% of 1.1412/1.0925 descend).

Res: 1.1034; 1.1045; 1.1079; 1.1111

Sup: 1.0990; 1.0970; 1.0925; 1.0900