Aussie dips after dovish RBA; dips face solid supports at 0.6800 zone

The pair fell to 1 ½ week low in early Tuesday’s trading after minutes of RBA last meeting signaled that the central bank would consider more rate cuts in the near future.

Weak Australian housing data (although better than expected but still well in the negative territory) contributed to fresh weakness, along with stronger US dollar ahead of Fed monetary policy decision on Wednesday.

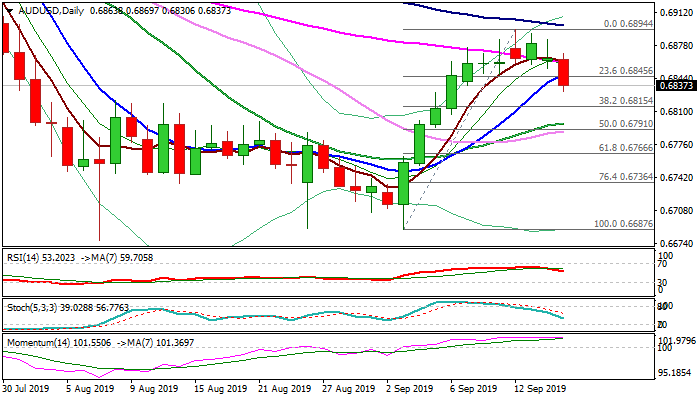

Repeated failures to clear pivotal barrier at 0.6795 (daily cloud top / Fibo 50% of 0.7082/0.6677) resulted in pullback which cracked daily cloud base, but holding above for now .

Bids lay at 0.6815 (Fibo 38.2% of 0.6687/0.6894) and 0.6798 (rising 20DMA) where extended dips should find footstep and keep bulls in play.

Broken 55DMA marks solid resistance at 0.6860, guarding key resistances at 0.6879/98/ provided by daily cloud and falling 100DMA, break of which will signal bullish continuation.

Res: 0.6860; 0.6879; 0.6898; 0.6927

Sup: 0.6830; 0.6815; 0.6798; 0.6766