Directionless mode extends but Brexit uncertainty weighs on pound

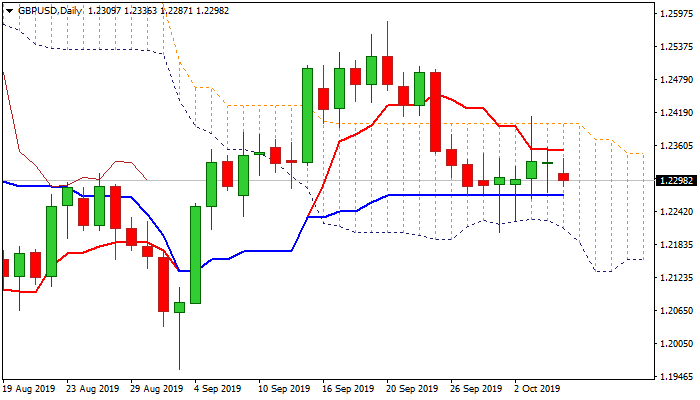

Cable stands at the back foot in early Monday after Friday’s post-NFP action failed to establish in fresh direction and ended in long-legged Doji, signaling strong indecision.

Near-term action holds in the middle of thick daily cloud, with initial support/resistance levels (sup 1.2270, daily Kijun-sen) and 1.2350 (daily Tenkan-sen / Fibo 38.2%) containing short-lived spikes for now.

Daily techs are bearishly aligned and add to negative outlook as Brexit uncertainty weighs on pound.

Break of 1.2275/70 pivots would generate initial negative signal and expose key supports at 1.2204 (1 Oct spike low) 1.2196 (Fibo 61.8% of 1.1958/1.2582) and 1.2186 (daily cloud base).

Violation of upper pivot (1.2350) would ease downside pressure, but only break above daily cloud top (1.2399) would provide relief.

Res: 1.2336; 1.2350; 1.2381; 1.2399

Sup: 1.2287; 1.2270; 1.2226; 1.2204