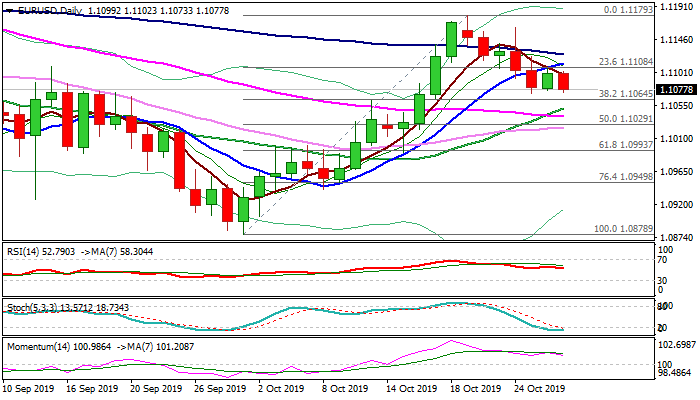

Directionless n/t mode between 1.1064 Fibo support at 1.1105 daily cloud top

The Euro holds in red on Tuesday and cracks lows of past two days (1.1073/75) after Monday’s advance was capped by daily cloud top (1.1105) and subsequent weakness erased previous day’s gains.

Signals from 4-hr studies are negative, as fresh weakness emerged below thick 4-hr cloud and indicators are in bearish setup.

On the other side, daily techs send mixed signals as daily Tenkan / Kijun-sen are in strong bullish configuration but positive momentum is fading and MA’s are in mixed setup.

Fresh weakness approaches important Fibo support at 1.1064 (38.2% of 1.0878/1.1179) violation of which would further weaken near-term structure and risk test of pivots at 1.1034/29 (daily cloud base / daily Tenkan-sen).

Ability to hold above 1.1064 Fibo level would signal prolonged sideways mode while daily cloud top continues to cap.

Only firm break here would sideline bearish risk and generate initial reversal signal.

Res: 1.1105; 1.1112; 1.1125; 1.1162

Sup: 1.1072; 1.1064; 1.1034; 1.1000