Bulls remain underpinned by daily cloud but unable to resume, awaiting signals from US data / Fed

Recovery lost traction in early European trading on Wednesday after German data showed stronger than expected rise in unemployment in October.

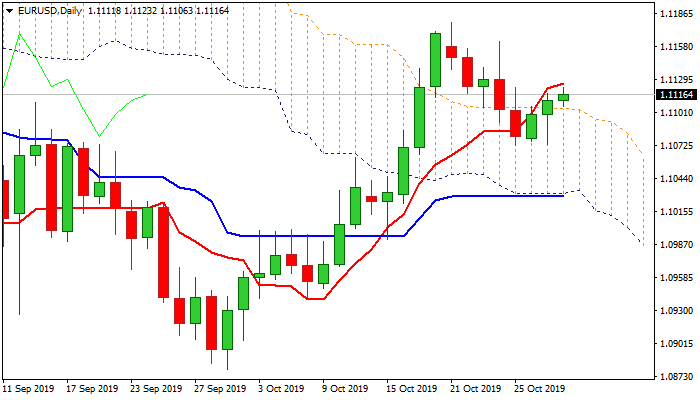

Bulls were capped by daily Tenkan-sen / 100DMA, but subsequent easing was mild and price action remains above daily cloud top (1.1105).

Tuesday’s break and close above daily cloud (following strong downside rejection which resulted in long-tailed bullish daily candle) was positive signal but bulls were so far unable to get confirmation on break above daily Tenkan-sen.

Daily techs remain mixed as Ichimoku studies are bullish, stochastic heads north, but positive momentum is fading that lacks clearer direction signal.

Traders focus on US ADP private sector jobs data (Oct 120K f/c vs 135K prev) which often acts as indication for coming NFP report (due on Friday) and US GDP (Q3 1.6% f/c vs 2.0% prev), ahead of today’s key event – Fed rate decision.

The US central bank is widely expected to cut interest rate by 0.25% for the third consecutive time and markets will also carefully listen comments from Fed chief Jerome Powell.

Res: 1.1125; 1.1162; 1.1179; 1.1198

Sup: 1.1105; 1.1072; 1.1064; 1.1034