Bears remain in control and pressure key supports despite solid German data

The Euro dips in early European trading on Monday, erasing the most of overnight’s recovery, despite positive news, as prevailing tone remains negative.

German Ifo data came in line with expectations, showing that business morale rose in November and the economy is improving after contracting earlier this year.

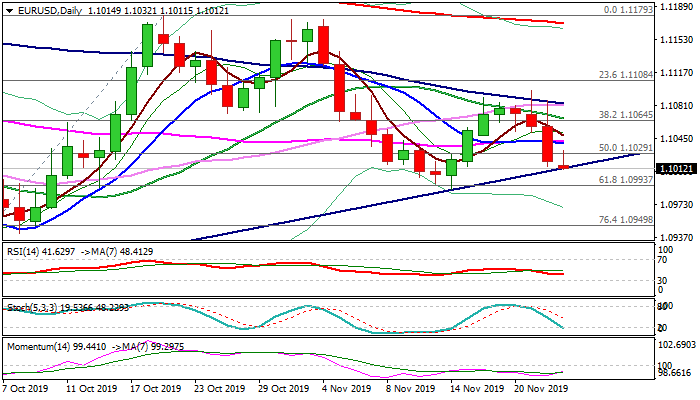

Weak daily studies remain strong obstacle for recovery attempts as large bearish candles with long upper shadows from last Thu/Fri and Friday’s close below daily cloud, weigh on near-term action.

Fresh weakness pressures pivotal support zone at 1.1011/1.0989 (bull-trendline off 1.0878 low / psychological 1.10 support / Fibo 61.8% of 1.0878/1.1179 / 14 Nov trough), break of which would generate strong bearish signal.

Meanwhile, bears face headwinds and may hold in extended consolidation, but expected to remain fully in play while holding below the base of narrowing daily cloud (1.1043) reinforced by daily Tenkan-sen.

Bounce above cloud top (1.1055) would sideline immediate downside risk, but extension and close above daily Kijun-sen (1.1084) is needed to neutralize bears and shift near-term focus higher.

Res: 1.1032; 1.1043; 1.1055; 1.1084

Sup: 1.1011; 1.1000; 1.0989; 1.0949