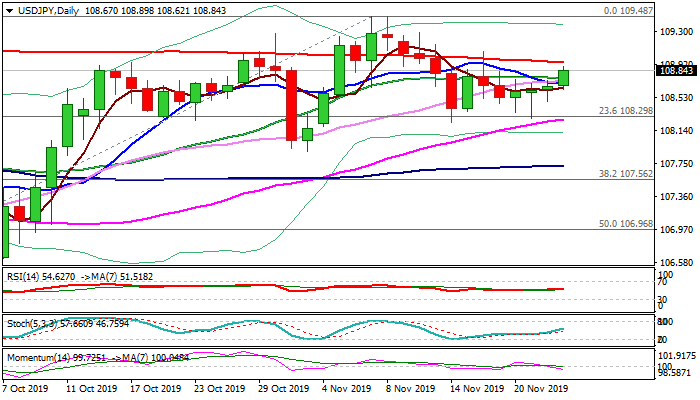

Fresh advance pressures pivotal 200DMA barrier

The pair regained traction after last week’s triple-Doji and edged higher on Monday, as fresh optimism over US/China trade talks boosted risk appetite, reducing safe-haven demand.

Fresh advance approaches key 200DMA barrier (108.94), break of which is needed to confirm higher base at 108.25 and generate positive signal for further advance.

Tops of 7/8 Nov (109.48) and thin weekly cloud (109.57/77) mark pivotal barriers and break here would signal bullish continuation.

Daily RSI turned up and stochastic is trending higher that underpins near-term action, along with magnetic weekly cloud twist, but momentum is moving in opposite direction and warning of recovery stall.

Failure to clear 200DMA would signal prolonged sideways mode between 108.25 and 108.94, while initial negative signal could be expected on break below 108.25 base that would open way towards key supports at 107.88/85 (1 Nov trough / top of ascending daily cloud).

Res: 108.94; 109.00; 109.29; 109.48

Sup: 108.62; 108.25; 107.85; 107.56