Limited recovery keeps the downside at risk

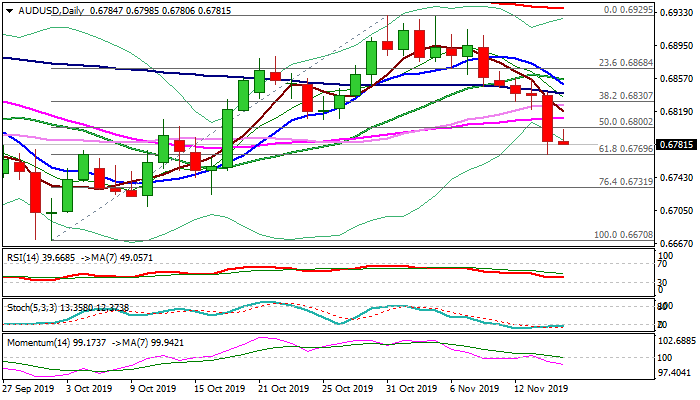

The pair weakened towards session low after recovery attempts in Asia stalled on approach to psychological 0.6800 barrier, but near-term action remains supported by daily cloud which twisted today and ascends (cloud top lays at 0.6785).

However, near-term risk remains shifted lower, following last week’s bearish close that marked the third consecutive week in red.

In addition, last Friday’s Doji with long upper shadow signaled indecision but also pointed to strong upside rejection, warning of limited recovery attempts.

Rising bearish momentum and multiple MA’s bear-crosses on daily chart keep the downside at risk for renewed attack at cracked key Fibo support at 0.6796 (14 Nov low / Fibo 61.8% of 0.6670/0.6929) loss of which will signal bearish continuation.

Conversely, close above 0.6800/10 zone would ease immediate downside risk, but extension above 0.6834 (19 Nov lower top) is needed to signal reversal and neutralize bears.

Res: 0.6800; 0.6812; 0.6830; 0.6840

Sup: 0.6780; 0.6769; 0.6751; 0.6723