Lira extends weakness despite solid Turkish data

The pair rose further on Monday and broke above 200DMA, as weakening lira failed to benefit from better than expected Turkish data, released earlier today.

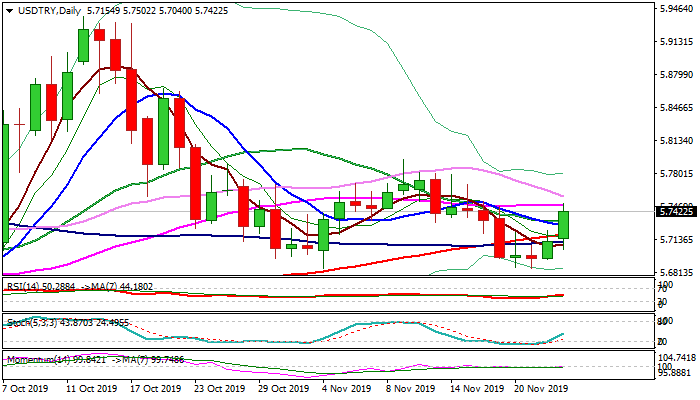

Fresh advance left temporary base at 5.6850 zone with return above 200DMA (5.7192) and extension to 5.7500, where 55DMA capped, signaling that probe below key 200DMA was short-lived on first attempt.

Recovery cracked daily cloud base (5.7418) but needs close within the cloud to open way for extension towards 5.7754/5.7814 (daily Kijun-sen / Fibo 38.2% of 5.9378/5.6848).

Confirmation of reversal and double-bottom (5.6848) would require extension above 5.7944 (11 Nov high).

Improving daily techs (RSI / stochastic / MA’s) support the advance, but momentum remains flat and warns of stall.

Broken 20/10DMA’s (5.7326/5.7297) mark initial supports which guard pivotal 200DMA, loss of which will be bearish.

Res: 5.7500; 5.7754; 5.7814; 5.7944

Sup: 5.7326; 5.7297; 5.7192; 5.7040