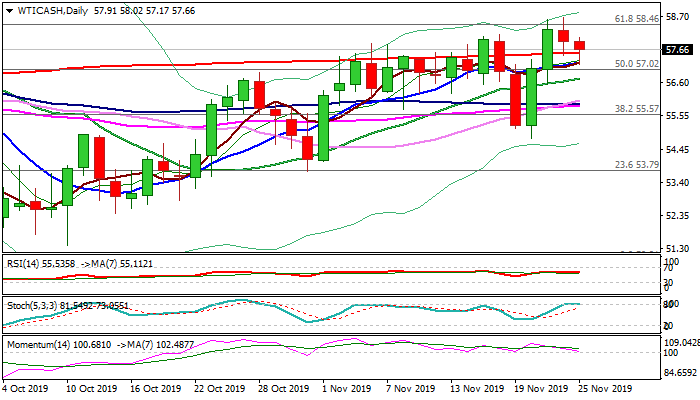

Pullback needs to hold above daily cloud top to keep bullish bias

WTI oil stands at the back foot on Monday and extends pullback after double-failure at pivotal Fibo barrier at $58.46 (61.8% of $63.12/$50.91) last Thu/Fri.

Fresh weakness dipped below important 200DMA support ($57.53) despite optimistic news that persisting US/China trade tensions could be resolved.

Correction of last week’s 5.5% advance, should ideally close above 200DMA, with extended dips expected to hold above pivotal supports at $57.02/$56.75 (daily cloud top / Tenkan-sen) to keep bulls in play.

Falling daily momentum indicator approaches the midline and stochastic is in sideways mode at the border of overbought zone, warning about risk of deeper pullback on violation of daily cloud top / Tenkan-sen.

Res: 58.02; 58.46; 58.67; 59.22

Sup: 57.53; 57.02; 56.75; 56.29