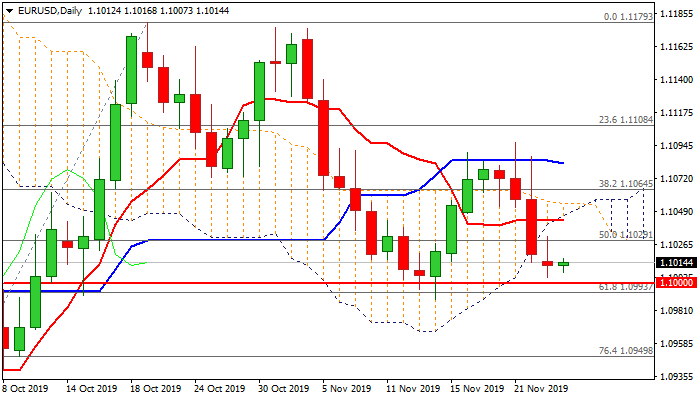

Daily cloud twist could attract for stronger recovery from key support zone

The Euro is consolidating above new two-week low at 1.1003 in early Tuesday’s trading after strong three-day fall faced headwinds from strong support zone at 1.1000/1.0990 (psychological support / Fibo 61.8% of 1.0878/1.1179 / 14 Nov trough).

Monday’s long-legged Doji signaled indecision as bears run out of steam ahead of key supports.

North-heading daily momentum and oversold stochastic support recovery scenario, along with tomorrow’s daily cloud twist, which could be also magnetic.

Bounce above cracked trendline support (1.1016) and broken Fibo 50% support (1.1029) is needed for initial bullish signal, which would be boosted by extension above daily Tenkan-sen (1.1043) and through thin daily cloud (1.1051/55).

Upper key levels lay at 1.1082 (daily Kijun-sen) and 1.1096 (21 Nov high), with break here needed to confirm reversal.

Limited recovery under Tenkan-sen / cloud would keep the downside vulnerable and risk retest of key 1.10 support zone, clear break of which would signal bearish continuation.

Res: 1.1029; 1.1043; 1.1055; 1.1082

Sup: 1.1000; 1.0989; 1.0949; 1.0940