Turkish lira stands at the back foot on rising political tensions and ahead of CBRT rate decision, Fed

The pair is consolidating under new seven-week high on Tuesday after advancing 1.1% in past two days, as dollar advanced on strong US jobs data while lira came under pressure on persisting tensions over purchasing Russian arms and the conflict with Greece on maritime boundaries. CBRT’s policy meeting is on Thursday and the central bank is expected to cut interest rates (12.5% f/c from 14.0%) which may lead to further weakness of lira.

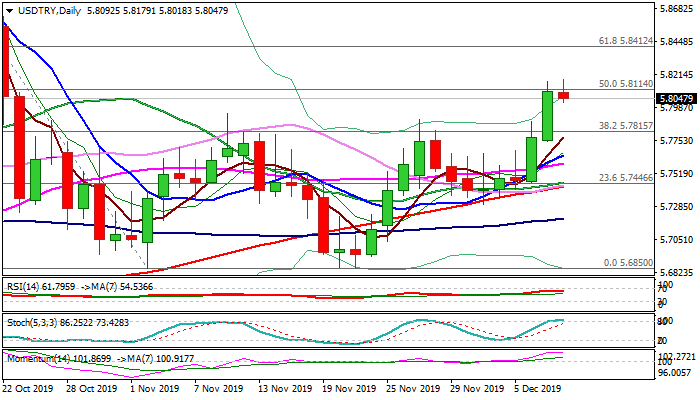

Recovery rally from 2.6850 double-bottom broke above pivotal barriers at 5.7903/44 (24 /11 Nov highs) and cracked Fibo barrier at 5.8114 (50% retracement of 5.9378/5.6850 descend). Break here would expose next key barriers at 5.8354 (daily cloud top) and 5.8411 (Fibo 61.8% of 5.9378/5.6850), violation of which would generate strong technical signal for lira’s further weakness.

Easing daily momentum and overbought stochastic suggest that the pair may hold in consolidative/corrective phase ahead of CBRT’s rate decision, which is seen as lira’s key driver.

Markets also focus Fed’s policy meeting on Thursday, as the central bank is likely to stay on hold but expected to give signals about their steps in 2020.

Former highs (5.7944/03) now mark solid supports and expected to hold and keep bulls intact, while deeper dips should be contained by rising 10DMA (5.7644).

Key supports lay at 5.7440 zone (converged 20/30/200DMA’s and break here would sideline bulls and turn near-term focus lower.

Res: 5.8114; 5.8179; 5.8354; 5.8411

Sup: 5.8018; 4.7944; 5.7903; 5.7644