Bears face headwinds from daily cloud base, fresh trade hopes

The Aussie bounced from the session low at 0.6800 at the start of US trading on Tuesday, on news that fresh round of tariffs due to start on 15 Dec, might be delayed.

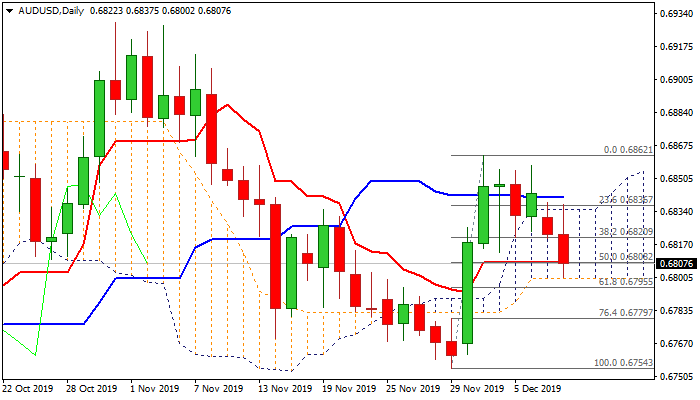

The pair remained in red during Asia and Europe following mixed results from Australia’s NAB business report, but bears found solid support at 0.6800 (daily cloud base) reinforced by Fibo 61.8% of 0.6754/0.6862 (0.6795).

Technical signals are mixed as momentum is flat on daily chart while stochastic and RSI head south and MA’ (10/20/55) are converged and in neutral setup.

Close within daily cloud (spanned between 0.6800 and 0.6834) would keep the price in consolidation, but near-term action will remain biased lower if today’s action ends in red.

Break of 0.6800/0.6795 pivots would provide fresh bearish signal for test of support at 0.6779 (Fibo 76.4%) and keep in play possible extension towards key near-term support at 0.6754 (29 Nov low).

Conversely, lift and close above 0.6820 (broken Fibo 38.2% of 0.6754/0.6862) would sideline near-term bears, but extension and close above daily cloud top (0.6834) is needed neutralize bears and shift focus towards 0.6862 (3 Dec high).

Res: 0.6820; 0.6834; 0.6841; 0.6857

Sup: 0.6800; 0.6795; 0.6779; 0.6761