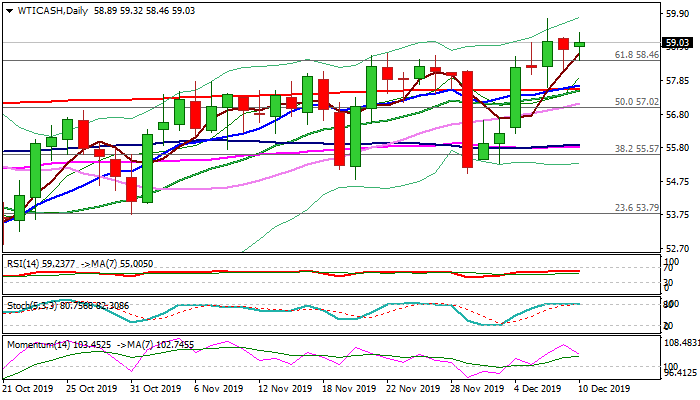

Consolidation extends into second day but bias remains bullish above broken $58.46 pivot

WTI oil holds in extended consolidation under new eleven-week high at $59.76, as fresh boost to oil prices on OPEC+ agreement to deepen production cuts was offset by renewed concerns about global demand outlook on US/China trade conflict.

Consolidation is holding above broken key Fibo barrier at $58.46 (after two consecutive daily closes above here generated bullish signal) which keeps bullish bias, but overbought daily stochastic and fading bullish momentum warn of deeper pullback on break below $58.46.

Cluster of converged MA’s (10/200/20DMA) provides solid support at $57.68/54 zone, where extended dips should be contained, to keep bulls in play and avoid deeper pullback.

Today’s repeated close above broken $58.46 Fibo barrier would reinforce bullish stance for eventual probe through $59.70 (weekly cloud top) and psychological $60 barrier that would expose $60.24 (Fibo 76.4%) and signal continuation of larger uptrend from $50.91.

Traders focus on today’s American Petroleum Institute report and Wednesday’s official weekly crude stocks data for fresh signals.

Res: 59.16; 59.70; 60.00; 60.24

Sup: 58.46; 58.18; 57.68; 57.54