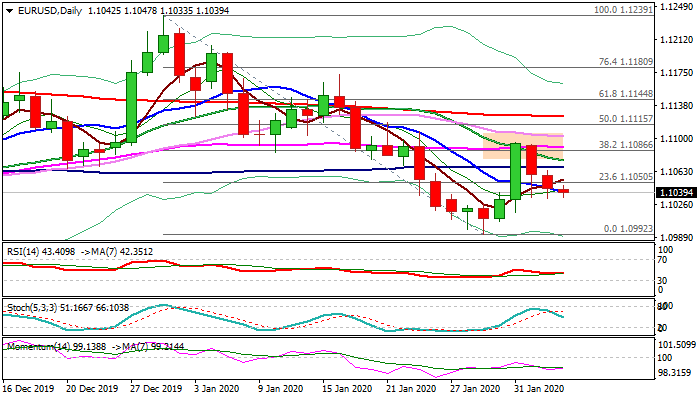

Bears continue to pressure key Fibo support as bull trap weighs

The Euro maintains negative tone on Wednesday and looks for retest of key Fibo support at 1.1031 (61.8% of 1.0992/1.1095 upleg) where bears repeatedly stalled in past two days.

Little positive impact was seen from better than expected European and slightly better German Services / Composite PMI data that keeps bears firmly in play.

Negative daily studies and bull trap above 1.1086 Fibo barrier (Fri/Mon) weigh on near-term action, while strong dollar adds to negative outlook.

Anticipation of bearish continuation on eventual break of 1.1031 pivot keeps near-term focus at 1.0992/81 (29 Jan / 29 Nov lows) targets.

Broken 100DMA (1.1068) needs to cap and maintain bearish bias, while only break above daily cloud (1.1090/1.1108) would bring bulls in play.

Res: 1.1047; 1.1056; 1.1068; 1.1076

Sup: 1.1031; 1.1000; 1.0992; 1.0981