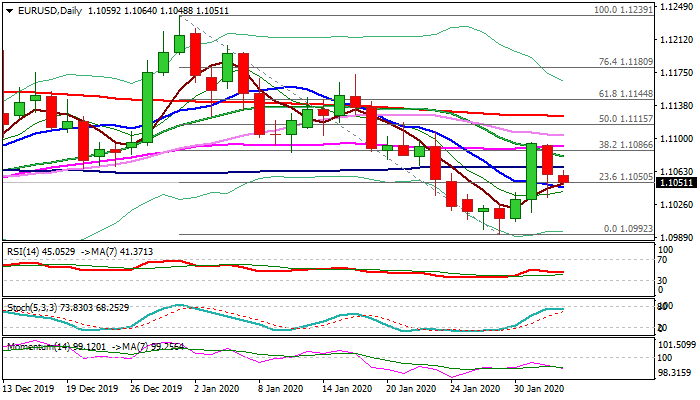

Bears remain in play for renewed attempt at key Fibo support at 1.1031

The Euro remains in red on Tuesday and probes again through cracked supports at 1.1056/50 (Fibo 38.2% / daily Tenkan-sen) after bears dipped to 1.1034 on Monday but subsequent bounce resulted in bearish daily candle with long tail.

Stronger dollar across the board on upbeat US manufacturing data weighs on Euro, with bearish daily studies adding to negative outlook.

Also, strong upside rejection at daily cloud base / Fibo 38.2% of 1.1239/1.0992 (1.1090/86) formed bull trap that maintains negative bias.

Daily close below 1.1056 Fibo support would further weaken near-term structure for renewed attack at 1.1031 pivot (Fibo 61.8% of 1.0992/1.1095 upleg), above which Monday’s bears were strongly rejected.

Broken 100DMA (1.1067) is expected to cap and keep bears in play.

Res: 1.1067; 1.1079; 1.1086; 1.1095

Sup: 1.1044; 1.1031; 1.1000; 1.0992