Sterling remains in red after heavy losses on renewed fears of hard Brexit

Cable extends weakness on Tuesday, following 1.38% fall on Monday (the biggest one-day fall since 17 Dec) as initial enthusiasm about officially leaving the EU faded and renewed fears about hard Brexit that sparked strong sell-off.

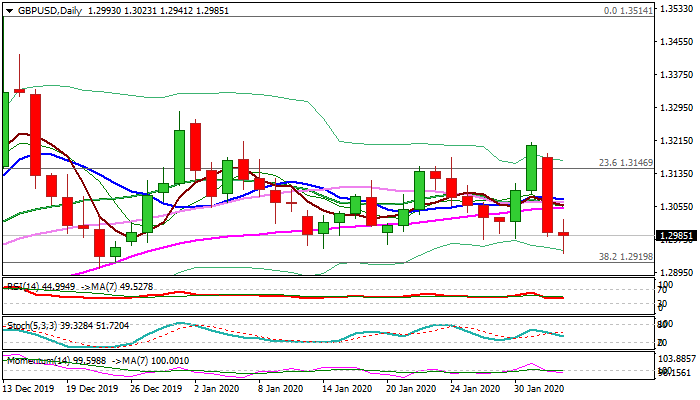

Fresh weakness broke and closed below thinning daily cloud and psychological 1.30 support, with today’s extension cracking trendline support (1.2975) and probing below the floor of January’s range at 1.2950 zone that brings in focus key Fibo level at 1.2919 (38.2% of 1.1958/1.3514 ascend).

Monday’s massive bearish candle weighs and bearish daily studies (rising negative momentum; MA’s in bearish setup; bearishly aligned daily Tenkan-sen/Kijun-sen turning south) add to negative outlook.

Break of 1.2919 pivot would generate fresh bearish signal for test of 1.2870 (100DMA) and possible extension towards 1.2736 (50% of 1.1958/1.3514 / weekly Kijun-sen).

Broken daily Tenkan-sen and cloud base (1.3075/85) offer solid resistances which are expected to cap upticks and keep bears in play.

Caution on tomorrow’s daily cloud twist which could be magnetic.

Res: 1.3023; 1.3075; 1.3085; 1.3112

Sup: 1.2941; 1.2919; 1.2870; 1.2800