Strong recovery fully retraces Friday’s fall and shifts near-term focus higher

The dollar regained traction and advanced strongly against the basket of major currencies on Monday, to fully retrace last Friday’s 0.52% fall (the biggest one-day fall in nearly six weeks).

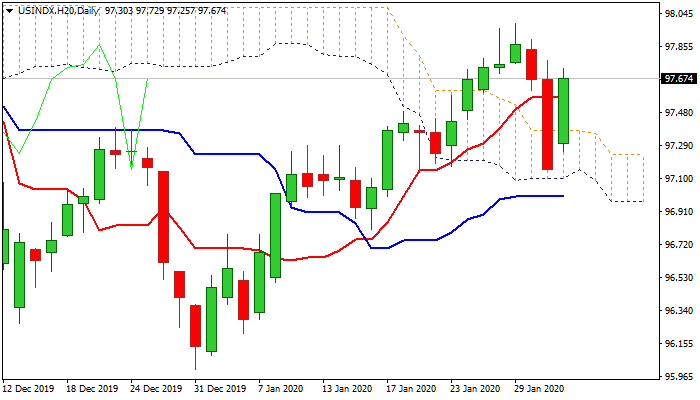

Friday’s drop has ran out of steam on approach to daily Ichimoku cloud base (97.10) and subsequent recovery bounced well above cloud top (97.37), signaling reversal and formation of higher low at 97.15 (Friday’s low).

Fresh advance also probes above double-Fibo barrier at 97.64/67 (50% retracement of 99.29/96.00 / Fibo 61.8% of 97.99/97.15 pullback) close above which would add to reversal signals and neutralize threats of formation of bull-trap pattern on daily chart.

Daily studies show rising bullish momentum and MA’s back to bullish setup that supports recovery.

The greenback generally benefits from risk-off mode on China virus spreading, but was on hold last Thu/Fri on strong rally on index’s main components: Euro, British pound and Yen.

Res: 97.72; 98.03; 98.50; 98.93

Sup: 97.55; 97.46; 97.30; 97.15