Bulls are pausing ahead of $1700 target, on track for the biggest weekly gains in nine years

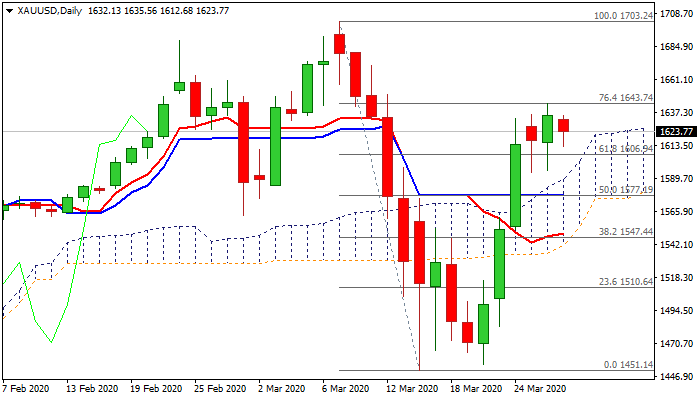

Spot gold eases on Friday, taking a breather after bulls failed to clear Fibo barrier at $1643 (76.4% of $1703/$1451 fall) on first attempt.

Overall picture remains positive as the yellow metal advanced nearly 8% this week and on track for the biggest weekly gains since the second week in Aug 2011.

Revived safe-haven demand as the US has overtaken China for the most coronavirus confirmed cases, signals of very strong negative impact on the US economy and weaker dollar on massive US stimulus, boost gold price.

Overbought daily stochastic warns of consolidative/corrective action, which is expected to be shallow, ideally to be contained by daily cloud top ($1600), as rising thick daily cloud underpins the action.

Bulls focus $1700 zone (2020 high lays at $1703) with eventual close above $1643 expected to open way towards target.

Caution od deeper pullback below $1600, which should not exceed next key supports at $1571 (daily cloud base / Fibo 38.2% of $1455/$1644 rally) to keep bulls in play.

Res: 1635; 1643; 1650; 1671

Sup: 1612; 1600; 1591; 1585