Gold’s safe-haven appeal fades on signals of US economy gradual restart

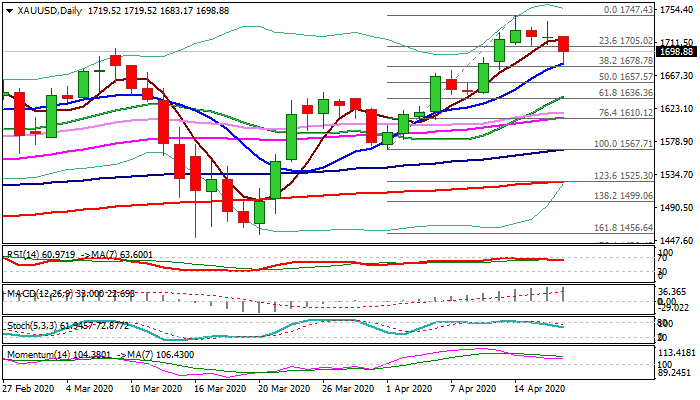

Spot gold extended pullback from new multi-year high ($1747) on Friday to initial support at $1683, marked by rising 10DMA.

Fresh bears were so far held here and the price edged higher on weaker dollar, but outlook remains negative and sees risk of deeper correction.

Announcement of US President Trump of gradual restart of the US economy improved risk sentiment among traders and metal’s safe-haven appeal started to fade.

Technical studies on daily chart partially support such scenario as momentum, RSI and stochastic are heading south, but negative signals are weighed by daily MA’s which still hold in full bullish setup.

Initial bearish signal could be expected on close below former high ($1703) while clear break of pivotal supports at $1983/78 (10DMA / Fibo 38.2% of $1567/$1747 bull-leg) is needed to confirm and open way for extension of pullback towards $1657 (50% of $1567/$1747).

Conversely, close above $1703 would sideline immediate downside risk for extended consolidation.

Res: 1700; 1703; 1712; 1719

Sup: 1683; 1678; 1670; 1657