Cable stands at the back foot but bears need confirmation on close below 10DMA

Cable fell to new one-week low at 1.2406 on Friday after attempts above 1.25 barrier stalled at 1.2522.

Firmer dollar which extends positive tone into third consecutive day, keep sterling at the back foot, after the UK government announced the coronavirus lockdown extension for at least three more weeks.

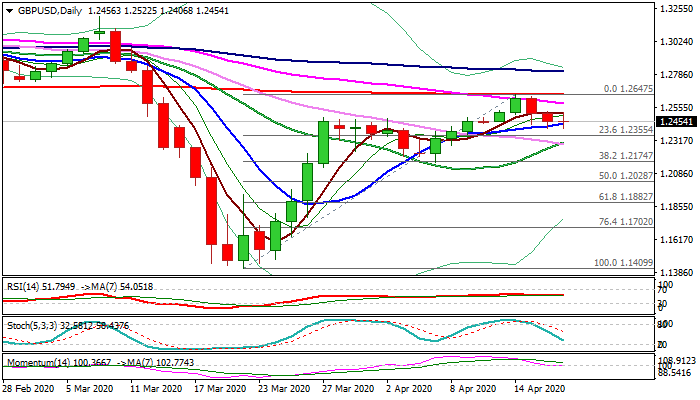

Flat daily momentum and RSI, along with mixed MA’s keep the pair afloat for now, as renewed probe through rising 10DMA (currently at 1.2440) so far did not result in clear break.

However, near-term focus remains skewed lower as the pair made a false penetration into weekly cloud (spanned between 1.2521 and 1.2669) and cloud continues to weigh.

Bears need close below 10DMA to generate a signal for continuation and attack at supports at 1.2355 (Fibo 23.6% of 1.1409/1.2647) and 1.2291 (rising 20DMA).

Repeated failure to close below 10DMA would keep near term action within extended congestion and awaiting fresh direction signals.

Res: 1.2521; 1.2585; 1.2630; 1.2647

Sup: 1.2406; 1.2355; 1.2291; 1.2241