Traders move into safe-haven ahead of President Trump’s speech on China

The dollar was sold in Asia / early Europe on Friday ahead of President Trump’s speech on China, due later today, as rising tensions over Hong Kong and fears of US reaction prompted investors into safe haven yen.

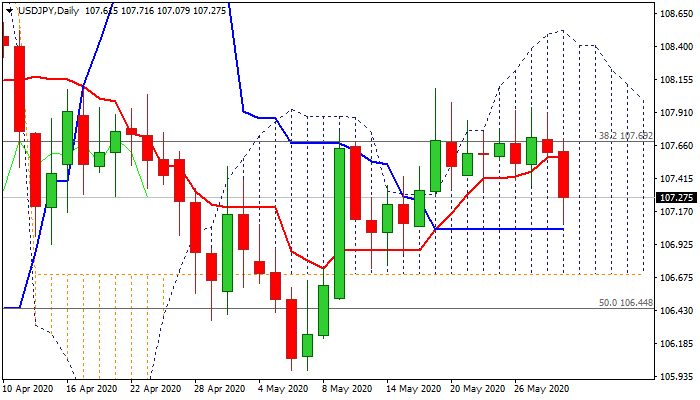

The pair was down nearly 70 pips, finding footstep at 107 zone (daily Kijun-sen / 50% of 105.98/108.08 upleg), but generated initial signal of an end of eight-day 107.30/108.00 congestion.

Fresh weakness eyes key support at 106.70 (daily cloud base) break of which is expected to generate stronger bearish signal for extension towards key support t 105.98 (7 May low).

South-heading stochastic and RSI and momentum breaking into negative territory, support scenario, as the pair remains capped by weekly cloud base for the second week, however, bears need to clear 107 handle and trigger stops parked below to accelerate.

Immediate downside risk would be sidelined if the pair manages to close today above 107 mark.

Res: 107.69; 107.92; 108.08; 108.34

Sup: 107.04; 106.70; 106.44; 105.98