Bulls focus 2020 high; US jobless claims and Eurogroup meeting could trigger stronger volatility

The Euro is consolidating under new three-month high (1.1422), after Fed’s projections for the long way recovery of the US economy and signal that rates will remain at ultra-low levels for some time, raised traders’ concerns and inflated safe-haven dollar.

Negative impact on Euro in post-Fed trading was so far limited as bulls remain firm on daily chart.

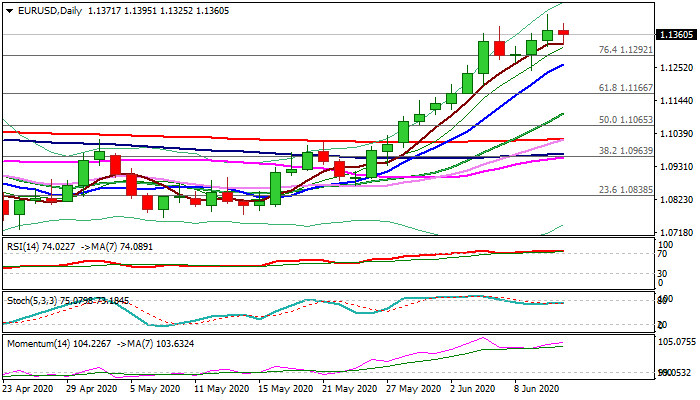

Momentum continues rise and MA’s are in full bullish configuration, with third consecutive close above broken Fibo 76.4% barrier (1.1292), adding to positive signals.

The pair is set for final push towards 2020 high (1.1494), but bulls may pause for consolidation before resuming.

Fundamentals are key factors today, with US weekly jobless claims expected to fall further (1.55M vs 1.87M last week), following surprise increase in nonfarm payrolls last Friday that raises optimism that the worst for the US labor sector might be over.

Eurogroup meeting is another key event for the single currency as EU finance ministers will discuss zone’s recovery fund, with persisting disagreement between the EU and some countries expected to keep the Euro volatile.

Bulls are expected to remain fully in play while holding above 1.1292 (broken Fibo 76.4% of 1.1494/1.0635) and rising 10DMA (1.1263) and keep 1.1494 target in focus.

Caution on break of these levels that may trigger deeper pullback and expose lower pivots at 1.1240 (9 June trough) and 1.1211 (Fibo 38.2% of 1.0870/1.1422 upleg).

Res: 1.1395; 1.1422; 1.1457; 1.1494

Sup: 1.1325; 1.1292; 1.1263; 1.1240