Another surprise build in crude inventories weigh on oil price after failure at $40 barrier

Unexpected rise in oil inventories by 8.4 million bls (API report on Tuesday) and 5.7 million bls (EIA report released today) weigh on oil prices on Wednesday.

Crude was boosted by decision of OPEC+ group to extend existing 9.7 million bpd production cut until the end of July, but positive impact was partially offset by decision of Saudi Arabia and its Gulf allies to stop additional voluntary cut.

Surprise increase of US oil stocks suggests that problem with drastically reduced demand could persist, despite the world economies restart after being shut during pandemic.

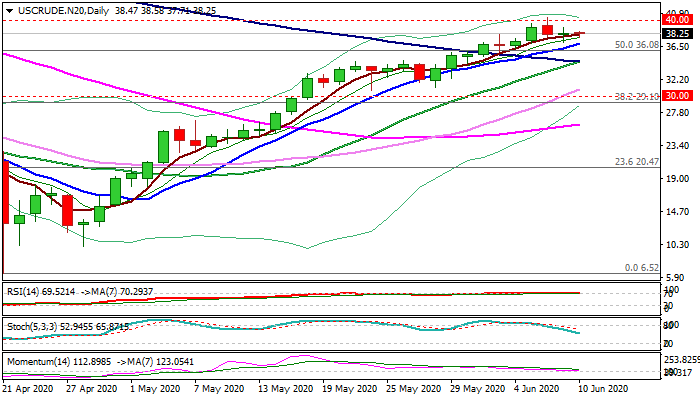

Failure on initial attack at psychological $40 barrier indicated that recovery rally faced headwinds needs to consolidate before resuming.

Consolidation so far holds above rising 10DMA ($36.89) keeping bullish bias, but drop and close below the indicator would generate negative signal and risk test of converged 20/100DMA’s ($34.56), loss of which would open way for deeper correction.

Res: 39.64; 40.00; 40.41; 41.04

Sup: 36.89; 36.08; 35.26; 34.56