Dollar extends weakness, on track for second consecutive week in red

The dollar fell to 2 ½ week low on Friday, being in red for the third straight day and on track for a second consecutive week of losses.

Renewed risk sentiment on rising bets for Biden’s victory in presidential election and expectations that he will offer bigger stimulus package after the election, deflated the greenback.

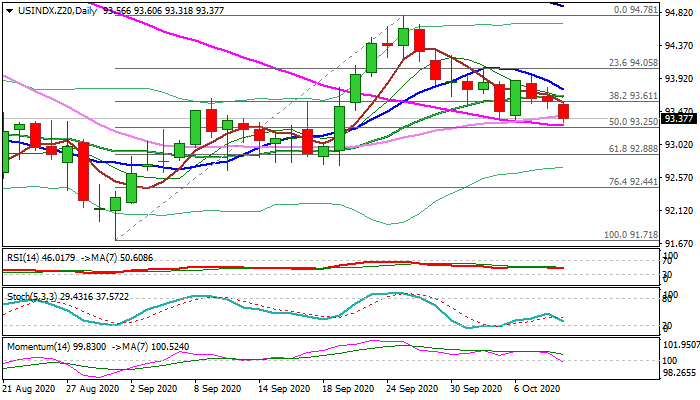

Fresh weakness cracked support at 93.35 (Tuesday’s low) and pressuring pivots at 93.28/25 (55DMA / 50% retracement of 91.71/94.78), loss of which would spark acceleration towards next key support at 92.69 zone (daily cloud base).

South-heading momentum on daily chart is about to break into negative territory, falling RSI moved from neutral zone and 10/20DMA in bearish setup, converging in attempt to form bear-cross and boost negative signals.

Res: 93.61; 93.77; 93.95; 94.05

Sup: 93.25; 92.88; 92.69; 92.44