Euro extends through key supports after strong fall on Thursday

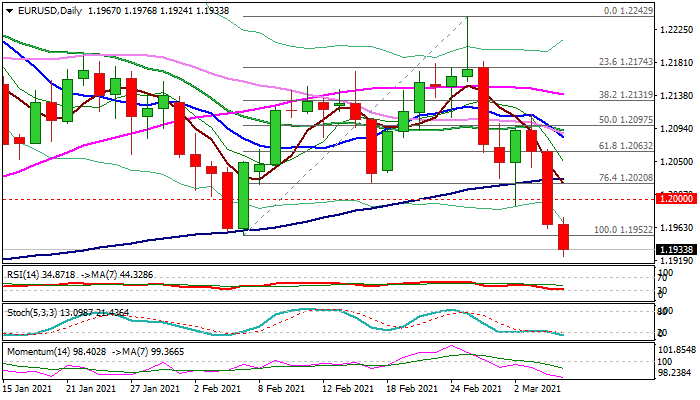

The Euro extends weakness in early Friday’s trading and probes through key short-term supports at 1.1952/45 (Feb 5 low / Fibo 23.6% of 1.0637/1.2349), following strong bearish acceleration on Thursday which resulted in close below psychological 1.20 support and daily fall of 0.8%.

The single currency was already at the back foot and came under increased pressure after Fed chief Powell reiterated the central bank’s view on keeping current ultra-accommodative policy and optimism that government stimulus and vaccine rollout would boost economic recovery that lifted the US dollar.

Near-term action is weighed by Thursday’s massive bearish daily candle and a negative signal generated on close below 1.20, with clear break of 1.1952/45 pivots to complete failure swing pattern on daily chart and open way for further weakness towards Fibo projections at 1.1883/41 and rising 200DMA at 1.1809.

Broken 1.1952 support reverted to initial resistance, guarding 1.2000/28 zone (psychological / 100DMA) and 1.2074 (daily cloud base).

The US labor report for February is in focus as key event today. Non-farm payrolls are expected to increase by 182K, following 49K rise in January, with upbeat results in February to add to signals the labor sector is recovering after December’s drop in NFP’s by 227K that would further boost optimism about recovery.

Traders however remain cautious as report from private sector, released earlier this week, disappointed by showing lower than expected hiring in February.

Res: 1.1952; 1.2000; 1.2028; 1.2063

Sup: 1.1900; 1.1883; 1.1841; 1.1809