Risk aversion pushes Euro to new four-month low

The Euro fell to new four-month low in early European trading on Wednesday, following Tuesday’s 0.72% drop, deflated by rising risk aversion on extended lockdowns across the Europe and dovish comments from US Treasury Secretary Janet Yellen.

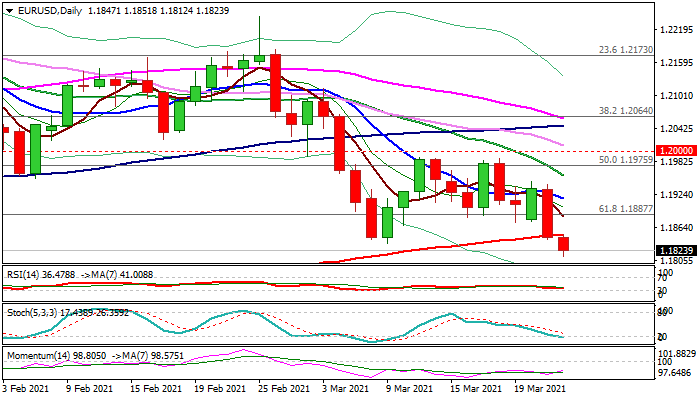

Tuesday’s bearish acceleration generated strong bearish signals on eventual break of pivotal Fibo support at 1.1887 (61.8% of 1.1602/1.2349) and marginal close below 200DMA (1.1852).

Fresh weakness further undermines larger bulls on Mar 2020 / Jan 2021 recovery rally), with rising risk of deeper fall.

Bears eye Fibo support at 1.1778 (Fibo 76.4% of 1.1602/1.2349), with break here to expose significant level at 1.1694 (Fibo 38.2% of 1.0635/1.2349).

Repeated close below 200DMA to confirm bearish stance, but daily indicators (14-d momentum bullish divergence and stochastic entering oversold territory) warn that bears may take a breather and consolidate before resuming.

Broken 200DMA marks initial resistance, with extended upticks to stay below broken Fibo level at 1.1887 and keep bears intact.

Only firm break above 10DMA (1.1916) would sideline bears.

Res: 1.1852; 1.1887; 1.1916; 1.1946

Sup: 1.1812; 1.1799; 1.1745; 1.1694