Aussie falls on risk-off mode but huge US c/a deficit weighs on greenback

The Australian dollar fell to two-week low on Tuesday, pressured by fresh risk-off mode as new Covid lockdowns and worries about vaccination slowdown boost concerns about global growth while a number of countries impose sanctions on China officials, adding to negative sentiment.

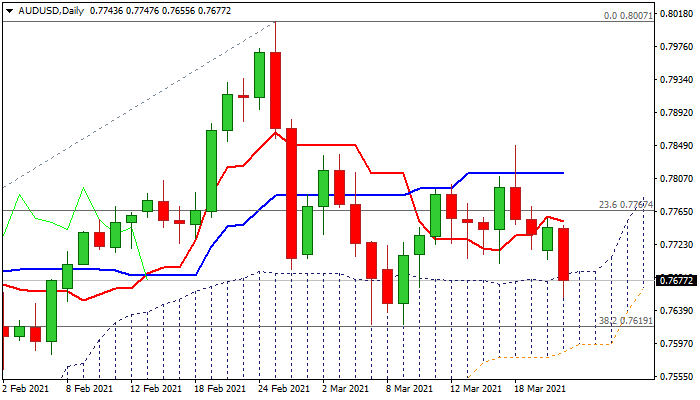

Daily chart shows moving averages (10/20/30/55) in bearish setup and rising negative momentum, as today’s eventual break of a higher base at 0.7700 zone, added to bearish signals and helped fresh weakness to penetrate rising daily cloud.

Bears need close within the cloud to confirm negative signals and open way for attack at next pivots at 0.7619 (Mar 5 low / Fibo 38.2% of 0.6991/0.8007 upleg) and 0.7596 (daily cloud base).

On the other side, massive US current account deficit, which has almost doubled in past two years, is expected to weigh on dollar that may slow Aussie’s bears.

Res: 0.7699; 0.7708; 0.7735; 0.7748

Sup: 0.7655; 0.7619; 0.7596; 0.7563