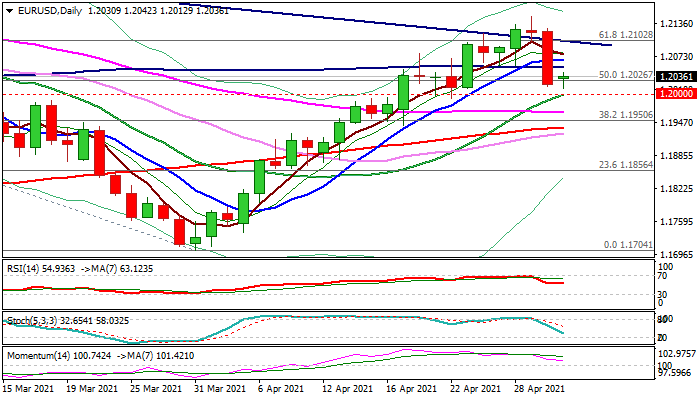

Bears are taking a breather above key 1.20 support

Upbeat German retail sales data helped the Euro to regain traction in early Monday, after 0.83% drop on Friday (the second biggest one-day loss in 2021) weakened the structure on daily chart by forming reversal pattern.

Bull-trap above Fibo barrier at 1.2102 additionally weighs on near-term action and warns of deeper fall.

Fresh bears found temporary footstep above strong supports at 1.2000 (daily cloud top / psychological / 20DMA), with break here and the nearby pivotal Fibo support at 1.1979 (38.2% of 1.1704/1.2149) to risk dip towards 1.1938 (daily cloud base / 200DMA).

Fading bullish momentum supports fresh bears which are expected to remain intact while holding below broken 100DMA (1.2051), former strong support, reverted to resistance.

Weaker than expected German manufacturing PMI data add to negative signals.

Res: 1.2051; 1.2065; 1.2077; 1.2102

Sup: 1.2012; 1.2000; 1.1979; 1.1938