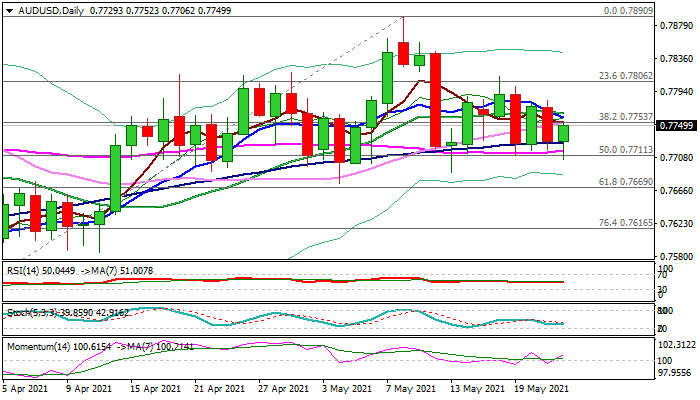

Near-term action remains congested between 55DMA and daily cloud top

The Australian dollar edges higher on Monday after a multiple failure at 55DMA (0.7716) which proves to be strong support.

Fresh advance is supported by rising bullish momentum on daily chart, but headwinds are expected at daily cloud top (0.7769) after last week’s several upside attempts failed to register a clear break higher, keeping the price congested for the seventh straight day.

Daily MA’s in mixed setup and RSI / stochastic in neutral mode, lack clearer signal that warns of prolonged sideways trading.

Bullish scenario requires sustained break above cloud top and lift above 0.78 trigger, to signal that bulls gained pace and confirm a higher base at 0.7710 zone.

Conversely, loss of 55DMA would generate initial bearish signal risk test of daily cloud base (0.7687).

Res: 0.7769; 0.7782; 0.7813; 0.7856

Sup: 0.7710; 0.7687; 0.7669; 0.7616