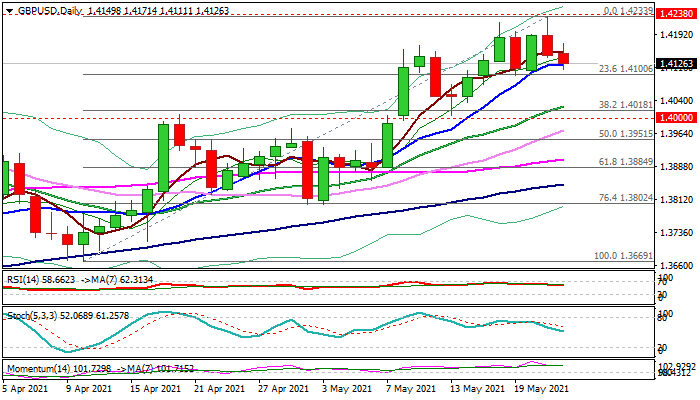

Bullish bias above 1.41 but risk of pullback exists

Cable is standing at the back foot in European trading on Monday, following Friday’s close in red after strong upside rejection just ticks ahead of 2021 high at 1.4238 (bulls spiked to 1.4233 before pulling back).

Fresh weakness on Monday stalled on approach to important support at 1.41 zone that keeps larger bulls in play, as sentiment is positive on expectation that accelerating vaccination would speed up economic recovery process as UK economy reopened after lockdown.

The address of four BoE policymakers to a parliamentary Treasury Select Committee is in focus today, with general view that the central bank is more upbeat on UK recovery than markets, suggesting pound should remain supported.

Daily studies are positive and support bulls but fading bullish momentum and stochastic about to reverse from overbought zone on weekly chart, send warning signals.

Caution on firm break of 1.41 zone, as many stops have been parked below this level that could spark fresh acceleration lower and expose supports at 1.4020/1.4000 zone (20DMA / Fibo 38.2% of 1.3669/1.4233 / psychological).

Res: 1.4171; 1.4200; 1.4238; 1.4265

Sup: 1.4100; 1.4076; 1.4036; 1.4020