Break of five-day congestion signals bullish continuation

The Euro jumped to new 4 ½ month high in early Tuesday’s European trading, lifted by fresh weakness of the dollar.

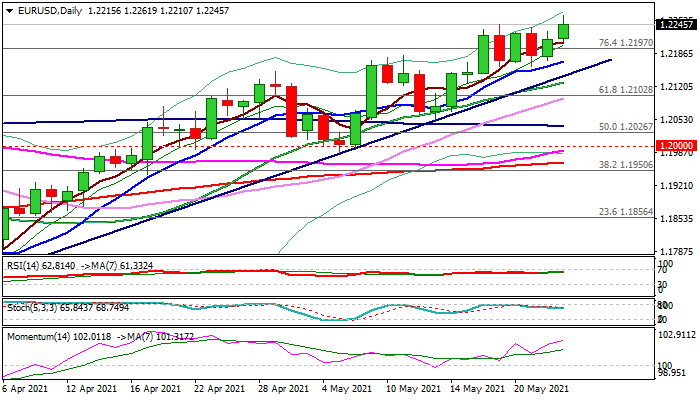

Fresh strength broke above five-day congestion and signaling continuation of the uptrend from 1.1704 (Mar 31 low), but daily close above recent range top (1.2244) is required to confirm signal.

Weaker than expected German GDP data did not have negative impact on the single currency, but upbeat German Ifo data (the highest in two years) could boost bulls.

Bullish momentum continues to rise on daily chart and underpins the action along with daily moving averages in full bullish setup.

Fresh advance pressures the upper 20-d Bollinger band (1.2273) and eyes round-figure barrier at 1.2300, which guards main target at 1.2349 (2021 high posted on Jan 6).

Rising 5DMA marks initial support at 1.2209, followed by broken Fibo 76.4% at 1.2197, which should hold dips and keep fresh bulls intact.

Res: 1.2273; 1.2284; 1.2300; 1.2349

Sup: 1.2208; 1.2197; 1.2171; 1.2152