Euro falls further as downbeat US jobless claims further sour weak post-Fed sentiment

The Euro extends sharp post-Fed fall on Thursday and fell to two-month low, additionally pressured by downbeat US weekly jobless claims data, after being deflated by hawkish Fed.

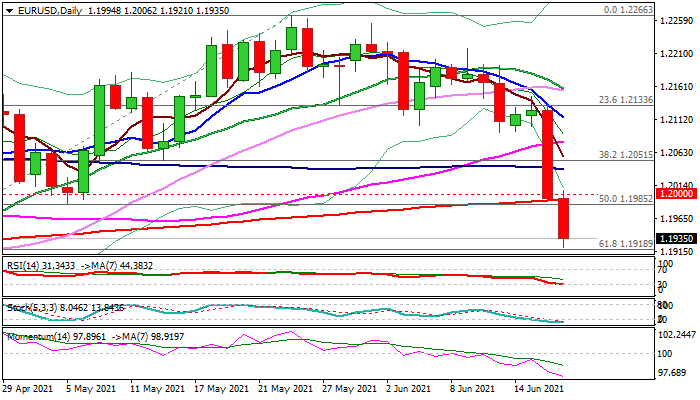

Massive Wednesday bearish daily candle (down 1.1% for the day, the biggest daily fall since 19 March 2020) weighs heavily, while today’s fresh bearish acceleration generated strong negative signal on break of 200DMA (1.1992) after Wednesday’s action registered close below psychological 1.20 support.

Bears also emerged from thick daily cloud (base lays at 1.1942) and pressure pivotal Fibo support at 1.1918 (61.8% of 1.1704/1.2266), close below which would further weaken the structure and add to negative near-term outlook.

Bearish daily techs maintain pressure with corrective action on oversold conditions to be anticipated.

Upticks should be ideally capped by broken 200DMA / 1.20 level and expected to provide better levels to re-enter bearish market.

Res: 1.1942; 1.1992; 1.2000; 1.2038

Sup: 1.1918; 1.1866; 1.1836; 1.1735