Bear-trap warns of correction but upticks likely to be limited

The Euro is trading within a narrow range in early Monday, as extended US holiday lowers volumes.

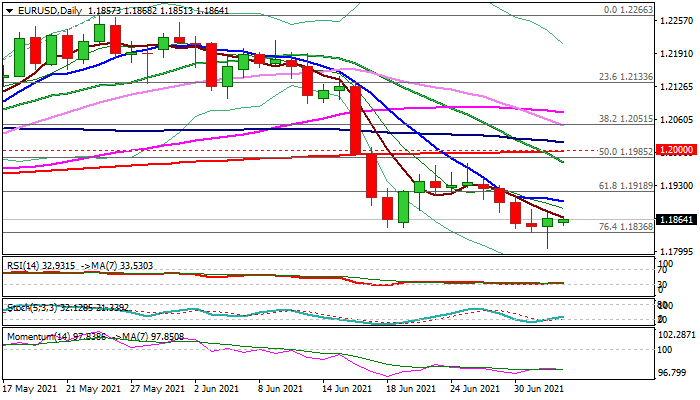

Last Friday’s post-NFP action left bullish candle (the first after four consecutive red daily candles) with long tail, marking the failure at pivotal Fibo support at 1.1836 (76.4% of 1.1704/1.2266) and generating initial signal of bear-trap.

This may put larger bears on hold as last week’s action failed to register a close below previous lows at 1.1847 (June 18/21), but recovery is likely to be limited and aiming to provide better selling opportunities, as daily studies remain in full bearish setup.

Falling 10DMA (1.1898) offers solid resistance, with extended upticks to stall under the lower top at 1.1975 (June 25) to keep bears intact.

Only violation of 1.1985/1.2000 breakpoints (daily cloud base / 200DMA / psychological) would neutralize bears for stronger correction of the downtrend from 1.2266 (May 25 peak).

Res: 1.1884; 1.1898; 1.1918; 1.1975

Sup: 1.1836; 1.1806; 1.1795; 1.1737