Yen regains traction but no direction while holding within 113.30/114.00 range; US CPI data in focus

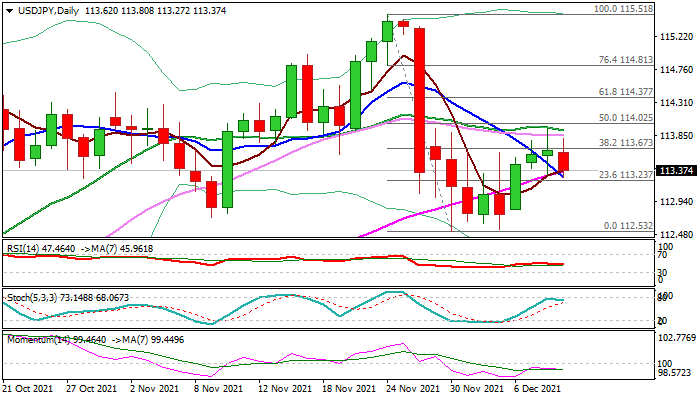

The USDJPY pair extends directionless trading for the third straight day, with the price action holding between the top of thick daily cloud which holds the downside and capped under 114 resistance zone, where Japanese exporters have offers and also 50% retracement of 115.51/112.53 pullback.

Mixed daily techs lack clearer add to indecision, with break of either side to generate initial direction signal.

Penetration and close within daily cloud would weaken near-term structure and increase risk of retesting pivotal 112.60 base.

Conversely, close above 114 zone would expose next key Fibo barrier at 114.37 (61.8% of 115.51/112.53).

Investors focus on Friday’s US inflation data which would give more evidence to the Fed ahead their policy meeting next week and also lift dollar on figure near or above forecast.

Res: 113.67; 114.02; 114.37; 114.69

Sup: 113.30; 113.09; 112.83; 112.53