The dollar pulls back from new multi-month high on overbought conditions, larger bulls remain intact

The dollar index edges lower in early Monday’s trading, following last week’s 1.6% advance (the biggest weekly rally since early June 2021) that resulted in hitting the highest in 18 months.

The greenback was lifted by growing expectations for US rate hikes after more hawkish than expected Fed (market expectations for four rate hikes by the end of the year rose above 90%), increased demand for safe haven assets amid growing geopolitical tensions and weak and volatile equities.

The dollar is on course for solid gains in January, with long-tailed monthly candle suggesting that the downside is well protected and adding to positive signals.

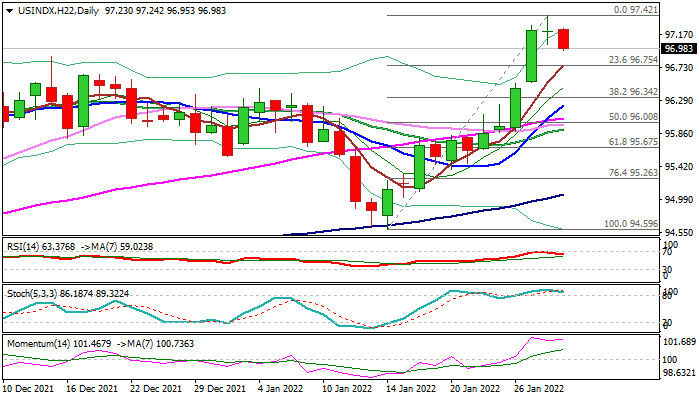

However, overbought conditions on daily chart suggest bulls may take a breather, with bearish close on Monday to complete reversal pattern and signal correction.

Initial support lays at 96.75 (5DMA / Fibo 23.6% of 94.59/97.42 upleg), with extended dips expected to find firm ground at 96.30 zone (top of thick daily cloud / Fibo 38.2% of 94.59/97.42 upleg / rising 10DMA) to keep larger bulls in play and offer better buying opportunities.

Caution on potential loss of 96.30 zone supports that would risk deeper pullback towards 96.00/95.67 (Fibo 50% and 61.8% retracement respectively).

Res: 97.42; 97.78; 98.00; 98.20

Sup: 96.75; 96.45; 96.30; 96.00