Limited correction likely to precede fresh weakness

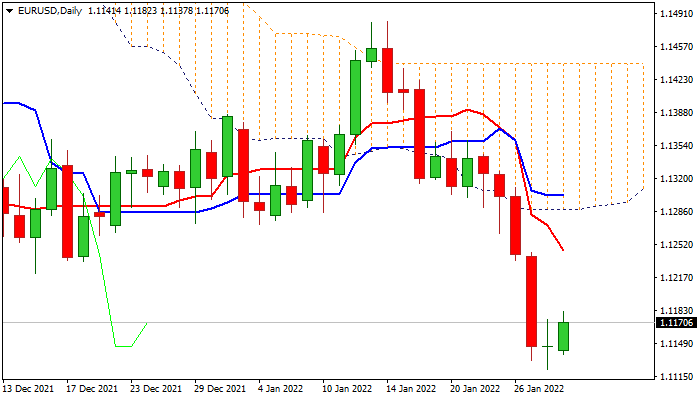

Bears are consolidating above new seven-month low (1.1145, posted on last week’s 1.74% fall) on Monday, with limited bounce before larger bears regain full control, seen as likely scenario.

Oversold stochastic on daily chart signals correction, but 14-period momentum on both, daily and weekly chart, remains deeply in negative territory, reinforcing underlying bearish bias.

Upticks should be capped by strong barriers at 1.1260/90 zone (Fibo 38.2% of 1.1482/1.1121 bear-leg / base of thick daily cloud) to keep bears in play for fresh push towards targets at 1.1040/00 (Fibo 76.4% of 1.0635/1.2349 / psychological).

Fundamentals may also work against the single currency, as ECB is expected to stay on hold on its policy meeting due later this week, that would add to concerns about accelerating divergence from the US Federal Reserve, after the Fed chief Powell sent signals for four rate hikes this year.

Res: 1.1200; 1.1260; 1.1290; 1.1305

Sup: 1.1121; 1.1100; 1.1040; 1.1000