Dollar is on track for further advance, consolidation likely to precede rally

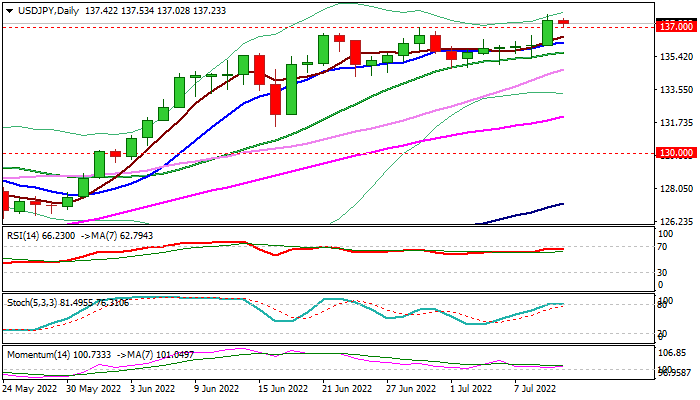

The USDJPY is consolidating under new highest level since Sep 1998 (137.75) in early Tuesday’s trading, following Monday’s bullish signal on 2.6% advance (the biggest one-day advance since June 17) and close above previous top at 137.00.

The dollar remains supported on expectations that Fed will remain aggressive in its monetary policy, short / medium inflation outlook remains pessimistic, with migration from risky assets to the safety on growing uncertainty over economic and geopolitical situation, additionally underpins the greenback.

Overbought conditions of firmly bullish daily studies, suggest that bulls may take a breather for consolidation before resuming towards Fibo projections at 138.21 and 138.57, violation of which would open way for attack at psychological 140 barrier.

Broken 137.00 level reverted to support whish so far holds, with dips expected to find ground above rising 10DMA (136.16) to bulls intact.

Res: 137.75; 138.21; 138.57; 139.14

Sup: 137.00; 136.52; 136.16; 135.60