WTI Oil – bears may take a breather for consolidation after 2.2% drop

WTI oil edged higher in early Wednesday, following 2.2% drop on Tuesday, positively impacted by stronger than expected draw in US crude inventories (API report) but keeps bearish bias.

Oil prices fell on Tuesday on fresh hawkish signals from central banks, warning that policy tightening cycle is still far from the end.

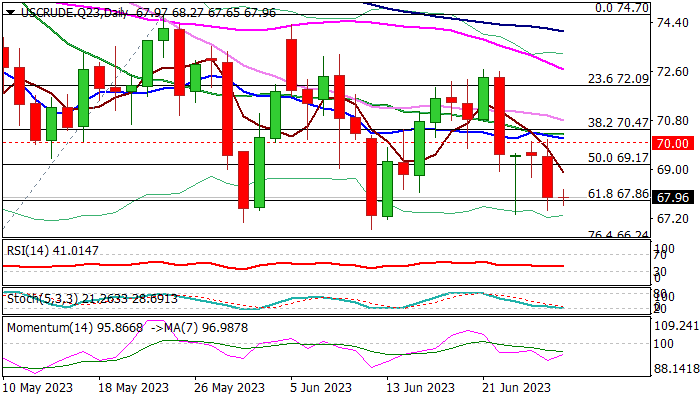

The WTI contract is holding below $70 level for the fifth consecutive, which weighs on near-term action and adds to negative outlook.

Bears pressure last Friday’s spike low ($67.33) ahead of more significant base at $67.00/$66.80 zone, violation of which would open way for retest of 2023 low at $63.63 (May 4).

Daily chart signals further losses as 14-d momentum is holding in negative territory and moving averages are in full bearish configuration, however stochastic is about to enter oversold territory.

This could increase headwinds the price is facing at $67.96 Fibo support (61.8% of $63.63/$74.70) where attacks repeatedly failed on Fri/Tue).

Consolidation should be narrow and capped under broken Fibo level at $69.17 (50% of $63.63/$74.70) to keep bears in play and guard upper pivot at $70 (psychological / daily Tenkan-sen).

Res: 68.68; 69.17; 70.00; 70.75

Sup: 67.33; 67.02; 66.80; 66.24