Dollar loses traction after US data

The dollar index came under pressure and accelerated lower in early US session, weighed by US PCE below expectations and sharp fall in consumer spending, which counter expectations for another Fed rate hike in July.

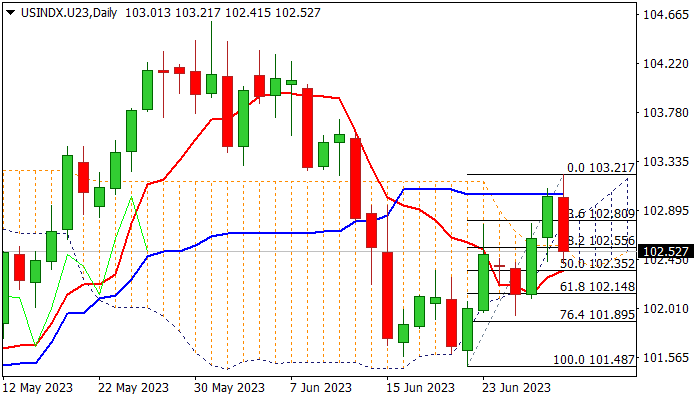

Fresh weakness so far retraced over 38.2% of 101.48/103.21 upleg and emerging below daily Ichimoku cloud which twisted on Thursday and is thickening, with additional negative signal developing on formation of a bull-trap above 103.04 (50% retracement of 104.59/101.18 descend).

Technical studies on daily chart are weakening as 14-d momentum moves deeper in the negative territory and south-heading RSI moved below neutral territory, supporting initial bearish signals, which will look for verification on close below daily cloud base (102.58) and extension below next pivotal support at 102.35 (daily Tenkan-sen / 50% retracement of 101.48/103.21).

The dollar index is on track to end month in red, with weekly action shaped in Doji candle, which points to overall weaker tone.

Markets shift focus to next Friday’s labor report for June, which will give more clues about Fed’s steps in July 25-26 policy meeting.

Res: 102.85; 103.04; 103.21; 103.41

Sup: 102.35; 102.14; 101.89; 101.48