Dollar Index – bulls take a breather ahead of key US labor reports

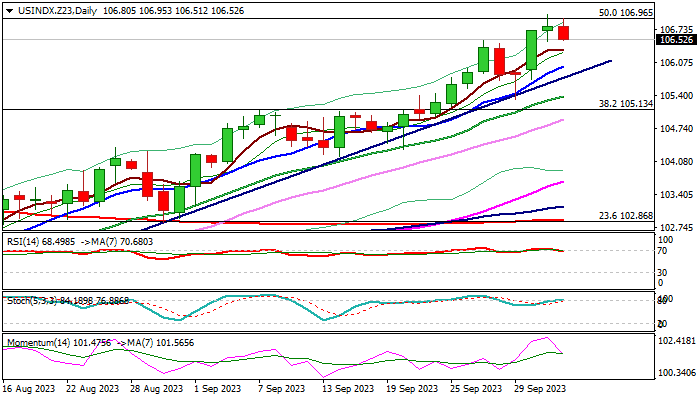

The dollar index edges lower from new 2023 high in European session on Wednesday, driven by a partial profit-taking, as the price faced headwinds at 107 zone (50% retracement of 114.72/99.20 downtrend / psychological / weekly Ichimoku cloud top).

The action could be seen as positioning for further advance, as the dollar remains supported by signals that the US Federal Reserve may keep high interest rates for some time to eventually push inflation towards 2% target.

Recent US economic data showed that the economy remains resilient despite negative impact from high borrowing cost that provides relief for the central bank.

Significantly better than expected US JOLTS report showed strong rise in job openings in August, adding to signals that the labor market remains tight and contributing to other positive signals however, ADP (due today) and NFP (Friday) reports are in focus and expected to provide more evidence about the situation in the sector.

Solid numbers from September’s labor report would add to positive signals and offer fresh support to the greenback.

Technical studies on daily chart are firmly bullish but overbought, which opens way for consolidation.

Dips should find firm ground above trendline support at 105.85 to keep larger uptrend intact for fresh push higher, with firm break through 107 resistance zone to signal bullish continuation and expose target at 108.79 (Fibo 61.8% of 114.72/99.20).

Caution on potential break below lower pivots at 105.85/35 (trendline / weekly cloud base) which would risk deeper pullback.

Res: 106.96; 107.13; 107.88; 108.79

Sup: 106.33; 105.85; 105.38; 105.13